What is a Digital Currency Wallet and How does it work?

Digital currencies such as Bitcoin, and other altcoins, allow you complete ownership, transparency, and access to your savings as an alternative to fiat money. A digital currency wallet is a type of cryptocurrency program used to send, receive, and store transactions.

If you’ve opted to accept Bitcoin as payment, you will need a digital currency wallet to send and receive bitcoins, much like you’d need Gmail or Outlook to send emails.

Digital currency wallets, also known as crypto wallets, keep track of cryptocurrency’s addresses on the blockchain and update the balances with every transaction.

On this page:

How do Digital Currency wallets work?

Digital currency wallets rely on the private and public key associated with your bitcoin or altcoin account.

The public key is what you want to give others to send and receive money from you.

The private key, similar to an email password, identifies the cryptocurrency as yours. You do not want to disclose your private key to anyone – whoever has access to the private key has control over your virtual currency. The private key is used to perform the functions of a wallet.

See also: Cryptocurrency 101: Understanding Digital Currency

Types of Crypto Wallets

You’ll need a place to keep your bitcoins and other altcoins before you can transfer or receive them.

The first step in receiving cryptocurrency is to select a wallet. A good wallet is vital for keeping your bitcoin secure.

There are various types of digital currency wallets, each catering to a particular set of needs based on security, convenience, the amount of cryptocurrency you maintain, and what you want to spend.

The following are the various types of bitcoin wallets.

1. Web wallet

Web wallets allow bitcoin transactions to take place using web browsers.

Web wallets provide ease and convenience by allowing you to manage your bitcoin with just an internet connection. Many web wallets need you to deposit funds into their online wallets before you can utilize them.

This wallet is the least secure since you do not have access to your private keys and must rely on a third-party website to implement security measures. It is advised that web wallets are only suitable for holding tiny amounts of money.

2. Software wallet

Software, or desktop, wallets are digital currency wallets that you download and install on your PC, laptop or mobile device.

While more secure than a web wallet, software wallets provide hackers more opportunities to access your private keys and hence your assets since it requires a machine that is free of security flaws.

Users of desktop wallets should be cautious about malware and water damage to their machine.

Apps on your mobile device save your private key in this form of wallet. Because they are so easy and user-friendly, you should not keep huge sums of money in mobile wallets.

Because they provide access to your wallet via internet connections, mobile apps offer little privacy and are less safe. However, because phones can be misplaced, broken, or stolen, users of mobile wallets should back up their private key.

3. Hardware wallet

These are physical devices that keep your private key and digital currency safe. Since hardware devices cannot be hacked and can only be used on public computers or the internet, they are the most secure type of wallet.

One disadvantage is that you must constantly have your hardware device with you to conduct transactions, which means you must always carry it with you.

Hardware wallets are costlier than other crypto wallets, which may be worthwhile for some individuals.

4. Paper wallet

Paper wallets are simply pieces of paper with the private key printed on them, usually as a QR code. Whoever has access to the paper has access to the wallet. The disadvantage of using a paper wallet is that it is easily destroyed, lost, stolen or misplaced.

How to get a Digital Currency Wallet

Receiving digital currency is just a function of the sort of wallet in which you keep your bitcoin. Paper wallets can be created using services such as BitAddress or Bitcoin paper wallet, which allows users to produce bitcoin addresses and private keys that can then be printed and stored offline.

In terms of mobile wallets, there are numerous digital currency wallet apps available for Android that allow for daily trading, including Free wallet, Edge, Atomic Wallet, Lumi Wallet, Blockchain Wallet, Copay, Jaxx, and Mycelium.

- Web wallets – Can be accessed through websites such as Lumi Wallet, Circle, Blockchain, and Xapo using an internet-connected device.

- Desktop/Software wallets – such as Electrum, Exodus, Atomic Wallet, Copay, and Armory, are downloaded and installed on your computer or mobile device.

- Hardware wallets – the most secure type of digital currency wallet, are accessible via a device such as a Ledger Nano S, Trezor, or KeepKey.

How to Create a Digital Currency Wallet

Before selecting a wallet, you should ask yourself the following questions to evaluate which wallet best meets your needs.

Other questions should be asked to select which wallet to establish, but the ones listed below are a good place to start.

- How frequently will I use the wallet?

- Will I be storing large or small amounts of bitcoin?

- How often will I use the wallet?

- What is the value of my privacy to you?

- Do I wish to delegate authority to a third party to protect my wallet?

How to Add Money to your Digital Currency Wallet?

To add funds to your wallet, you must first purchase the cryptocurrency on an exchange and then send them to your preferred wallet. Among the most popular exchanges are:

Digital currencies can be purchased with a credit or debit card or a SEPA bank account. You will need to enter your wallet address to send the purchased cryptocurrency to your account, and the funds should be available in your wallet.

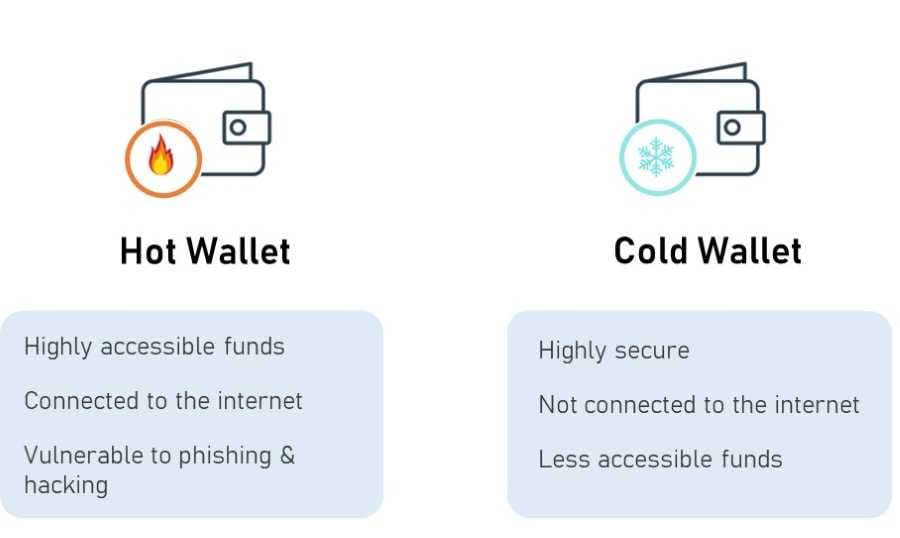

What is a Hot Wallet and Cold Wallet?

Hot wallets sometimes referred to as online wallets, require an internet connection. Hot wallets include web, software, and mobile wallets.

Cold wallets are entirely offline and can be paper or hardware wallets.

What are Public and Private keys?

Your private key is a random string of numbers and letters that allows you to spend Bitcoin. The private key is critical because anyone who has access to or knows your private key controls your Bitcoin.

If your crypto private key is compromised or lost, you will no longer be able to access your Bitcoin. The public key can be shared with anybody you wish, from whom you want to accept cryptocurrency.

What is Backup Key?

A backup key is a file that contains your digital currency wallet’s private key and is exportable or importable to your wallet.

If the device on which your digital currency wallet is installed is destroyed, lost, stolen, or otherwise compromised, your backup key will be available to restore and prevent the loss of virtual currency.

The backup key is viewed as additional protection, a type of insurance. It is recommended that users backup their data as a precaution.

How to Secure your Digital Currency Wallet

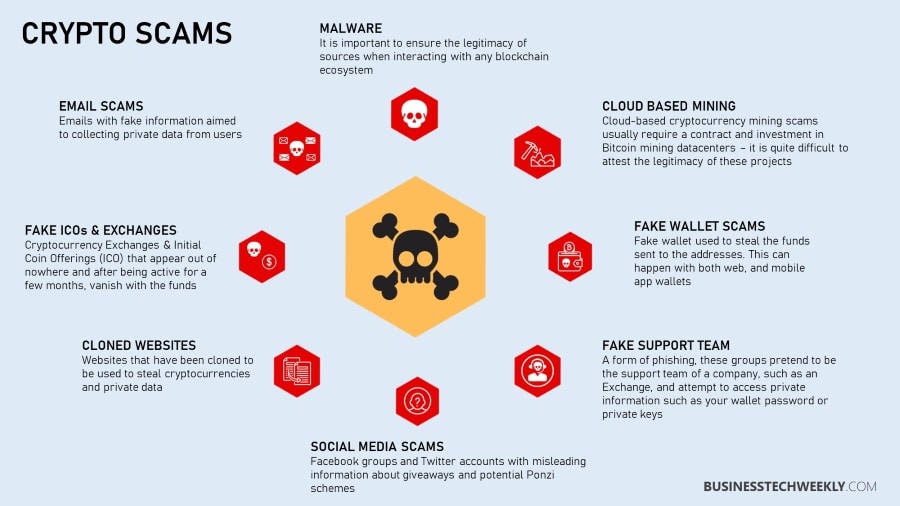

The majority of the threats to your digital funds come from bitcoin wallets (digital or crypto wallets) or exchange providers.

Cybercriminals utilize sophisticated methods to hack digital wallets and steal/transfer cryptocurrency assets without the user’s knowledge. It is therefore vital to ensure your digital currency wallet is secure.

1. Select hardware wallet if possible

If possible, you should use a hardware wallet such as such as a Ledger Nano S or Trezor.

Hardware wallets, which use two-factor authentication for security, are the most secure type of wallet to save your bitcoin and store key information of all the wallets described and reviewed.

2. Maintain your private key offline

Using cold storage solutions is a great way to protect your savings. It eliminates the risk of hacking and other risks associated with online wallets.

3. Use a secure internet connection

If you do decide to use cold storage, make sure to use a secure internet connection. Connecting to public networks potentially exposes your digital currency wallet to cybercriminals hackers. It is better to utilize your home WiFi or a personal hotspot or VPN in public places.

4. Keep antivirus software up-to-date

Keeping your bitcoin system up to date will assist you in maintaining prevention and rapidly resolving security issues. To keep your wallet safe, keep your mobile and computer devices updated by checking for updates and fixes that can protect you from viruses or trojans.

5. Do not click on any strange links

When attempting to gain access to your account, hackers are frequently inventive. Be aware of clone URL sites and scam emails that require you to enter your details to validate your account.

6. Create a secure password

It is recommended that the password be entirely random and devoid of any familiarity. Personal information such as birthdays, favorite colors, and so on should be avoided. You should never forget your password because doing so would result in losing all funds in that wallet.

7. Never give your private key to anyone

It is well understood that anyone who knows or has access to your private key has access to your digital currency and is free to manage it as they see fit. For your security, you should never reveal your private key to anyone.

8. Maintain a separate virtual wallet for daily transactions

Separate your spending money from your saved money. You don’t want to risk losing significant sums when you require a small amount daily. There is no limit on the number of wallets you can have. Therefore nothing is prohibiting you from designating specific wallets for specific uses.

9. For online wallets, use two-factor authentication

To prevent theft, you should use multi-signature. Two-factor authentication is simply one type of security precaution that allows you to double-authorize transactions in the event of fraud or an accident.

10. Check the bitcoin address at all times

When sending bitcoin, make sure to double-check the recipient’s address. Systems can be hacked to divert payments to another account.

11. Back up your digital currency wallet

Backup enables you to restore your wallet if your system crashes, is lost, or is stolen. You should keep a backup or numerous backups and keep them in a secure location that only you know.

12. Small quantities for everyday use

You wouldn’t walk around with massive amounts of cash for everyday use for fear of loss or theft, just like you wouldn’t walk around with large amounts of money for fear of loss or theft. Similarly, digital currency wallets intended for daily use should only store a minimal quantity.

Disadvantages of Crypto Wallets

Bitcoin is a popular way of payment for products and services, and it comes with its own set of advantages and disadvantages. Here are a few of the challenges that bitcoin faces.

Potential of theft

As we have explored the necessity of security in bitcoin wallets, it is evident that one of the numerous concerns is the possibility of theft. Cryptocurrency is a popular target for cybercriminals all over the world. Although multiple security measures may be implemented to avoid this, there is always the possibility that funds will be stolen.

Acceptance

Bitcoin, which was created in 2009, became a hot topic trend and was adopted by some, but it is still not widely regarded as a common form of cash today. The public’s acceptance is most likely due to the challenge of bitcoin being user-friendly enough for the masses to grasp. Many online businesses accept bitcoin, but it will be some time before we can pay restaurants and grocery stores with bitcoin.

Tax issues

To prevent problems with the IRS, the use of bitcoin will necessitate a certain amount of record-keeping for each bitcoin purchase and transaction.

Which Crypto Wallet is best for you?

With so many types of wallets available, deciding which one is ideal for you might be difficult. You should assess your needs to determine how to meet them within the constraints of your budget. Different people will utilize various Bitcoin wallets for multiple objectives.

For example, if you are a seasoned bitcoin user and security is your primary concern, selecting a hardware wallet, such as Trezor, which provides some of the highest levels of protection, would be prudent.

However, if you are a newbie who is just getting started with digital currency wallets, it may be better to use a more user-friendly wallet, such as a desktop or smartphone wallet.

The needs of digital currency wallet users range from anonymity to convenience, ease of use, price, and popularity, and there are various sorts of wallets that may cater to each user’s needs.

How much do Digital Currency Wallets cost?

If you want to ensure your virtual cash remains secure, you should consider purchasing a hardware wallet. Hardware wallets range in price from $50 to $100 but are well worth the money in the long term.

The majority of web, desktop, and mobile wallets are free and provide dependability and simplicity.

Difference between an Digital Currency Exchange and a Web Digital Currency Wallet

As previously said, a digital currency wallet is where you save your bitcoin. A cryptocurrency exchange is a location where you may swap fiat currency for digital currency and vice versa. Exchanges are also utilized to add funds to your digital currency wallet.

In contrast to a digital currency wallet where you have access to the private keys, you would save your private keys in the website’s wallet and only access it from within the exchange.

Final Thoughts

Because of its anonymity, transparency, and ease of use, Bitcoin, which is used and distributed electronically, has become a popular type of digital currency. However, just as cash can be stored in several ways, there are many ways to store virtual currencies.

You can keep things simple with a web-based digital currency wallet or even have multiple types of wallets. However, it is advisable to retain complete control of your crypto with a hardware wallet, such as Ledger Nano S or Trezor.